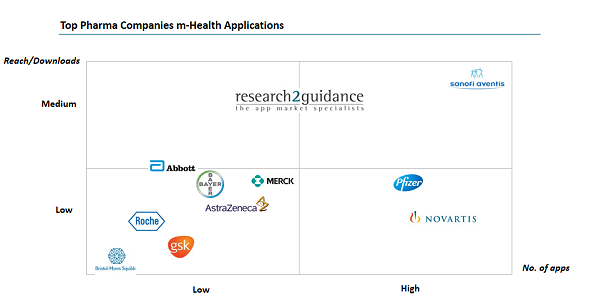

Today, there are nearly 250 apps created by pharmaceutical companies available on iOS and Android. The apps run the gamut from those focused on managing chronic medical conditions (among the most common apps created for personal use) to medical reference apps geared towards doctors. Most of these apps fail to generate more than a few thousand downloads each. Only Sanofi Aventis’ portfolio of apps counts more than 1 million downloads, but even that number isn’t so high compared to industry leaders like Runtastic (fitness tracking), Medscape (a leading medical resource for doctors and nurses) and Healthtap (connects patients with doctors around the world), counting millions of users.

Here are three reasons why pharma hasn’t managed to play a more dominant role in the mHealth app market yet.

1. Missing adoption of best practices

Best practice apps are being used on a daily basis, to connect via social channels, use gamification elements, use innovative technology to create a “wow-effect”, etc. These best practice apps are graphically compelling, can be used intuitively, provide APIs to connect to third party data/ functionality and are just incredibly helpful for their target group. Most apps from larger pharma companies fail to meet the best practice criteria today.

2. Too little focus on main market app categories

Of the 250 pharmaceutical apps currently available on iOS and Android, many are focusing on managing specific health conditions or provide medical reference for HCPs. While this might be an expected strategy to stay close to core competencies, it also means that pharma companies voluntarily exclude themselves from the bigger mobile app markets inside (e.g. fitness and wellness apps) and outside (e.g. games) of the mHealth app category.

3. Lack of integration of apps with core business

Increasingly, the medical community is realizing that selling pharmaceutical products only might not be the best long-term strategy, and that apps can help to educate and engage patients and HCPs and finally to sell their products.

By linking their apps to products & services, rather than separating them, pharma companies can use the mobile space to directly connect with patients and doctors. Compliance apps with automatic prescription refills or sensor supported diabetes apps that create new demand for test strips are just two examples to link apps to existing business.

To gain some traction in the app space, the pharmaceutical industry should pay more attention to what app market leaders are doing. The app world offers many new business opportunities to increase revenues reduce costs and add value to existing products. The common trial-and-error approach must be replaced by an app strategy development process that engages all “app managers” within a company.

The mHealth app market is highly fragmented. With many different treatments and possible mHealth solutions pharmaceutical companies are spoilt for choice, which apps to build for the mobile arena. At the moment the pharmaceutical industry has not yet been able to play a bigger role in the mHealth app market, even though this industry possesses a wealth of resources. There is also a great mismatch between the topics pharma companies are concentrating on and the topics top apps players are focusing on.

This is one of the results of two new reports that have been published beginning of August 2013: The mHealth app performance benchmarking report and the Top 10 Pharma companies mHealth insight paper. To understand the full potential of the mobile health app market for traditional healthcare players and new market entrants read our “mHealth app market report 2013-2017”.

About research2guidance:

research2guidance is a Berlin-based mobile app economy specialist. The company’s service offerings include app strategy consulting, market studies and research.

Link to blog post: http://www.research2guidance.